BoC policy rate

The Bank of Canada’s recent monetary policy decisions have created a remarkable opportunity for Montreal homeowners and prospective buyers. With an additional 0.25% policy rate cut announced on October 29, 2025, prime has moved lower again, reinforcing the most favorable borrowing environment in over two years. Together with the September 17 move that brought prime to 4.70%, this marks a decisive step down from the 6.95% peak reached in June 2023.

For Montreal’s real estate market, these reductions translate into practical, measurable savings—especially for variable-rate mortgage holders whose payments adjust with prime. Whether you currently hold a variable-rate mortgage, are approaching renewal, or are considering your first home purchase, it is essential to understand how the latest 0.25% cut affects your monthly budget and long-term interest costs so you can make informed decisions.

Summary of the Bank of Canada’s October 29, 2025 announcement

- Decision: The Bank of Canada lowered the policy interest rate by 0.25%, citing easing inflation pressures and softer economic momentum.

- Transmission: Lenders reduced their prime rates by 0.25% the same day, which directly lowers rates on variable-rate mortgages and HELOCs.

- Guidance: The Bank maintained a data-dependent stance, noting that future moves will reflect incoming inflation, growth and labour-market data.

What this means for Montreal buyers and homeowners, right now:

- Variable-rate mortgage holders with adjustable payments see an immediate payment decrease as prime falls.

- Variable-rate holders with fixed payments see more of each payment going to principal, helping you build equity faster.

- HELOC borrowers pay less interest immediately, improving monthly cash flow.

- Buyers see slightly improved affordability; in some cases, lower debt-service ratios may modestly increase borrowing capacity, though prudent budgeting remains crucial.

1. Immediate Relief Through Lower Monthly Payments on Variable-Rate Mortgages

Variable-rate mortgage holders are experiencing the most direct and immediate benefits from the Bank of Canada’s rate cuts. Since variable rates are intrinsically linked to the prime rate, every reduction flows directly to your monthly payment calculations—often as soon as your lender updates prime.

What does a 0.25% cut mean in dollars?

- About $14 less per month for every $100,000 borrowed on a 25-year amortization

- Roughly $55-60 less per month on a $400,000 mortgage

- Roughly $70-75 less per month on a $500,000 mortgage

If you secured a variable-rate mortgage when rates peaked at 6.95%, your monthly payments have already decreased significantly. For a typical Montreal home valued at $500,000 with a $400,000 mortgage, the difference between the peak rate and today’s environment represents monthly savings of approximately $450-550, depending on your specific terms and amortization period. The latest 0.25% cut adds to that relief and improves cash flow immediately.

This substantial reduction in monthly payments frees up meaningful cash flow in your household budget, creating opportunities to fund other financial goals or simply improve your day-to-day quality of life.

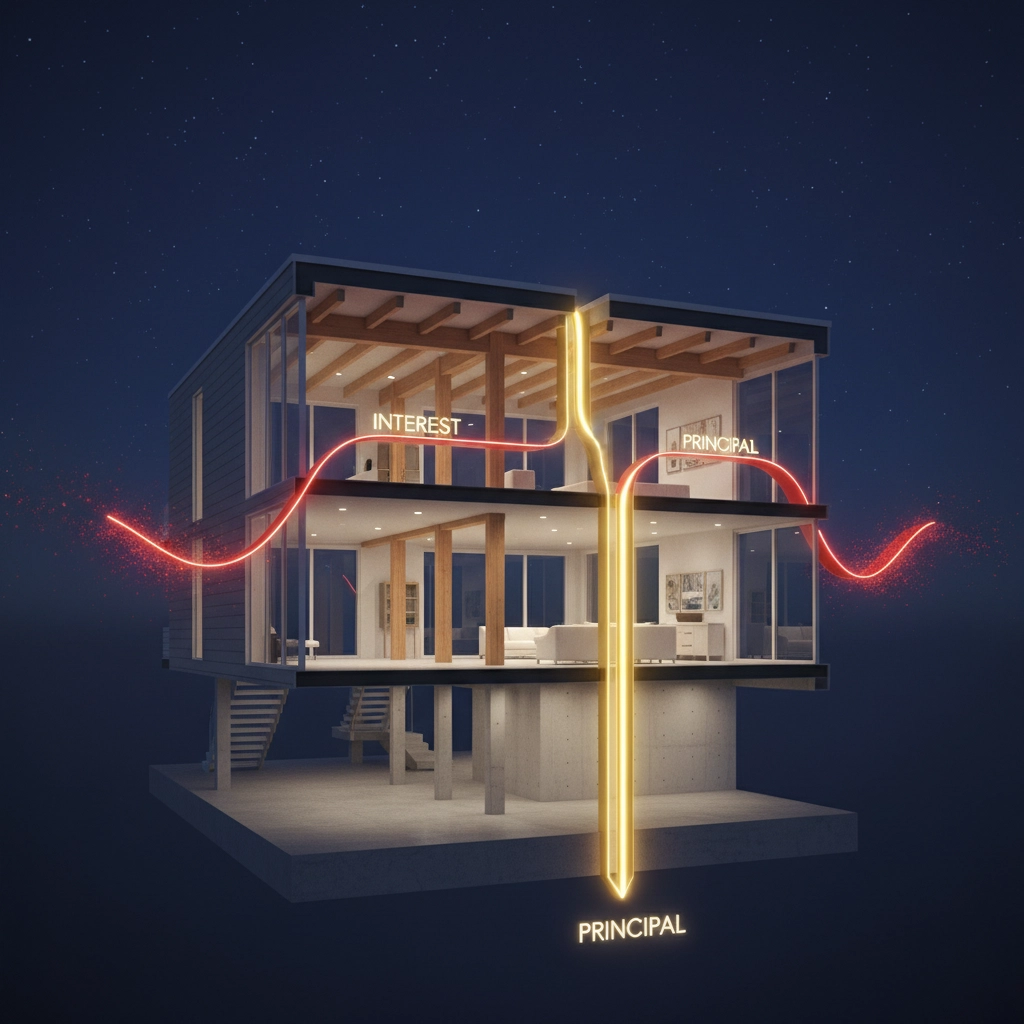

2. Accelerated Principal Repayment Without Increasing Your Payment

One of the most advantageous aspects of rate decreases lies in how major lenders structure their payment adjustments. Many financial institutions, including RBC and TD, maintain your original payment amount when rates drop, automatically directing the savings toward your mortgage principal.

This mechanism creates a powerful wealth-building effect. Instead of reducing your monthly payment, you’re accelerating your mortgage payoff timeline while building equity faster. On a 25-year amortization, this approach can shave 2-4 years off your mortgage term, translating to tens of thousands in interest savings over the life of your loan.

To maximize this advantage, I encourage you to voluntarily keep your payments at the level they were when rates were higher, even if your lender automatically lowers the required amount.

3. Substantial Reduction in Total Interest Costs Over Your Mortgage Term

The cumulative impact of lower interest rates extends far beyond monthly payment relief. Each percentage point reduction in your mortgage rate compounds over the entire term of your loan, creating substantial long-term savings.

Consider this practical example: A Montreal homeowner with a $400,000 mortgage who benefited from the full 225 basis point rate reduction (from 6.95% to 4.70%) saves approximately:

- Monthly: $450-550 in reduced payments

- Annually: $5,400-6,600 in interest savings

- Over 25 years: $135,000-165,000 in total interest reduction

These savings represent a genuine financial transformation for Montreal families, freeing up considerable resources for other important life projects.

4. Strategic Positioning for Additional Rate Cuts and Timing Flexibility

Current market forecasts suggest the Bank of Canada may continue its easing cycle, with potential for additional rate reductions bringing the overnight rate to as low as 2.25% by late 2025. Variable-rate mortgage holders are perfectly positioned to benefit from any further cuts without taking additional action.

This flexibility also provides strategic timing advantages. If you’re currently on a variable rate and economic indicators suggest rates have reached their trough, you can lock in a fixed rate. Conversely, if further cuts appear likely, maintaining your variable rate maximizes your savings potential.

The ability to make this decision based on evolving economic conditions, rather than being locked into a predetermined rate, represents significant value in today’s dynamic interest rate environment.

5. Dramatic Savings Compared to Recent Peak Rate Environment

For homeowners who maintained their mortgages through the 2022-2023 rate hiking cycle, the current environment offers relief that cannot be understated. The contrast between peak rates and today’s levels illustrates the magnitude of savings now available.

Comparative Analysis for a $500,000 Montreal Home (80% LTV):

- At peak rates (6.95%): Monthly payment of approximately $2,870

- At current rates (4.70%): Monthly payment of approximately $2,320

- Monthly savings: $550

- Annual relief: $6,600

This substantial improvement in cash flow helps Montreal families regain financial stability and plan their long-term projects with greater confidence.

6. Advantageous Refinancing and Renewal Opportunities

Montreal homeowners approaching mortgage renewal are entering negotiations in a dramatically improved rate environment. Those who locked in fixed rates during 2022-2023, when five-year terms exceeded 6%, now face renewal opportunities at rates potentially 2-3% lower.

This renewal advantage creates several strategic options:

- Switch to variable rates: Currently offering better value than fixed rates in most scenarios

- Negotiate improved terms: Leverage competitive rate environment for better conditions

- Consider refinancing: Access equity for renovations or investments at favorable rates

- Optimize amortization: Reduce term length while maintaining similar payments

For homeowners with equity positions exceeding 20%, the current environment presents opportunities to refinance investment properties, consolidate higher-interest debt, or fund major home improvements at historically attractive rates.

7. Enhanced Cash Flow for Comprehensive Financial Planning

The improved cash flow resulting from lower mortgage payments creates opportunities for comprehensive financial planning that extends well beyond housing costs. Monthly savings of $400-600+ can be strategically deployed to strengthen your overall financial position.

Recommended cash flow optimization strategies:

- Emergency fund building: Establish 3-6 months of expenses in liquid savings

- RRSP maximization: Increase retirement contributions while maintaining similar total housing costs

- Debt consolidation: Pay down higher-interest credit cards and personal loans

- Investment diversification: Build non-registered investment portfolios

- Education funding: Contribute to children’s RESP accounts

This holistic approach turns mortgage savings into long-term wealth-building opportunities, positioning your family for lasting financial success.

Maximizing Your Rate Cut Benefits: Next Steps

To fully capitalize on the current rate environment, consider these actionable strategies:

For current variable-rate holders: Following the October 29, 2025 0.25% cut, review your payment schedule and consider keeping payments at their previous level to accelerate principal. Continue to monitor upcoming Bank of Canada decisions and maintain flexibility in your rate strategy.

For fixed-rate mortgage holders: Evaluate your renewal timeline and begin discussions with mortgage professionals 120-180 days before your term expires to secure optimal rates.

For prospective buyers: The current rate environment, combined with increased inventory in Montreal’s market, creates favorable purchasing conditions for qualified buyers.

At North East Real Estate & Mortgage Agency, we help Montreal families navigate these opportunities through our integrated approach to real estate and mortgage services. Our team monitors rate movements daily and provides personalized strategies to maximize your savings potential.

The current rate environment represents more than temporary relief – it’s an opportunity to fundamentally improve your financial position through strategic mortgage management. Whether you’re looking to reduce payments, accelerate equity building, or optimize your overall financial plan, these rate cuts provide the foundation for achieving your homeownership and wealth-building goals in Montreal’s dynamic market.

READ OUR PREVIOUS BLOG: How to Choose the best Real Esate Broker