Canada Mortgage Rates Forecast 2026: Fixed vs Variable: Which Is Better For Your Renewal?

If your mortgage renewal is approaching in 2026, you’re likely asking yourself a critical question: should I lock in a […]

If your mortgage renewal is approaching in 2026, you’re likely asking yourself a critical question: should I lock in a […]

The Canadian mortgage landscape is entering a pivotal period as we approach 2026. With the Bank of Canada having cut […]

BoC policy rate The Bank of Canada’s recent monetary policy decisions have created a remarkable opportunity for Montreal homeowners and […]

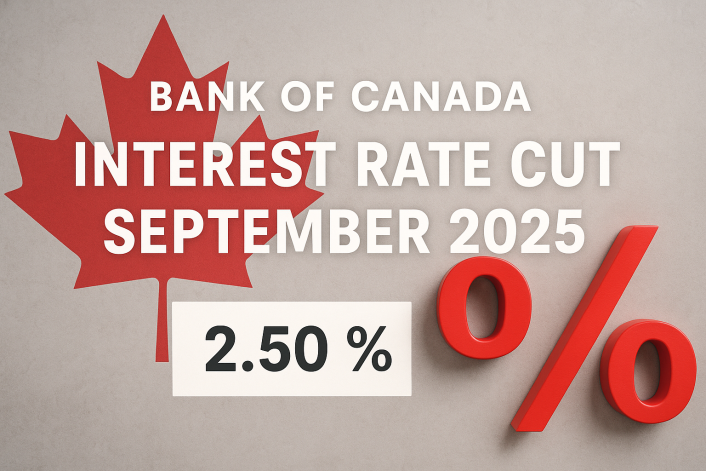

Bank of Canada reduced its target for the overnight rate by 25 basis points, from 2.75 % to 2.50 Date: […]

Bank of Canada April 2025 interest rate decision

Bank of Canada cuts interest rates by 25 basis points to 2.75%

The Bank of Canada has cut interest rates to 3%, marking a major shift in monetary policy

Bank of Canada has cut its policy rate by 50 basis points to 3.25%, aiming to support economic growth and stabilize inflation.

Canada’s GDP revisions have raised eyebrows, with stronger-than-expected growth figures for 2021 through 2023.

Canada’s mortgage rates are expected to see gradual changes over the next few years, with potential rate cuts as the economy stabilizes.