Canada Lending Rate Forecast 2026: What Montreal First-Time Buyers Need to Know

The Canadian mortgage landscape is entering a pivotal period as we approach 2026. With the Bank of Canada having cut […]

The Canadian mortgage landscape is entering a pivotal period as we approach 2026. With the Bank of Canada having cut […]

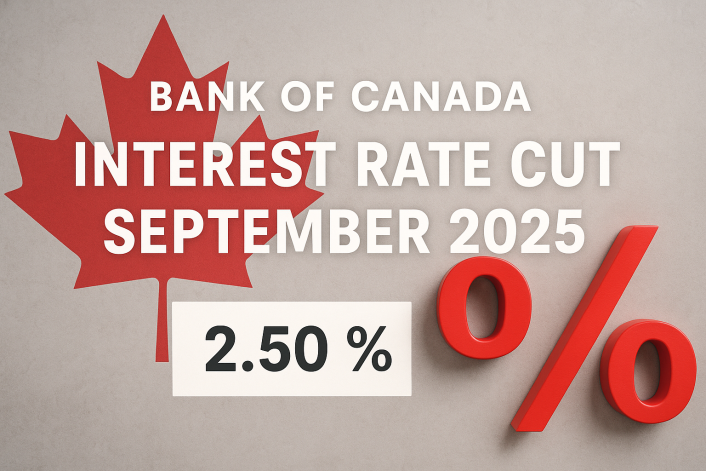

Bank of Canada reduced its target for the overnight rate by 25 basis points, from 2.75 % to 2.50 Date: […]

In a landmark move aimed at making homeownership more accessible for Canadians, the federal government has announced its most significant […]

Debt can be a double-edged sword. It provides the means to achieve goals, be it buying a home, a car, […]

In the labyrinth of homeownership, securing a mortgage stands as one of the most pivotal junctures. Aspiring homeowners often find […]

Owning a home, once a hallmark of stability and security, has become increasingly out of reach for many Canadians, especially […]

In today’s world of real estate, understanding the intricacies of mortgages is crucial for homeowners and potential buyers. One aspect […]

In the ever-evolving landscape of the mortgage industry, choosing between a fixed and variable mortgage has become a critical decision […]

As a seasoned mortgage broker with over 17 years of experience in the field, I’ve seen countless clients struggle with […]

In the ever-evolving world of mortgage financing, one of the most significant challenges homeowners face is dealing with higher interest […]