Canada Lending Rate Forecast 2026: What Montreal First-Time Buyers Need to Know

The Canadian mortgage landscape is entering a pivotal period as we approach 2026. With the Bank of Canada having cut […]

The Canadian mortgage landscape is entering a pivotal period as we approach 2026. With the Bank of Canada having cut […]

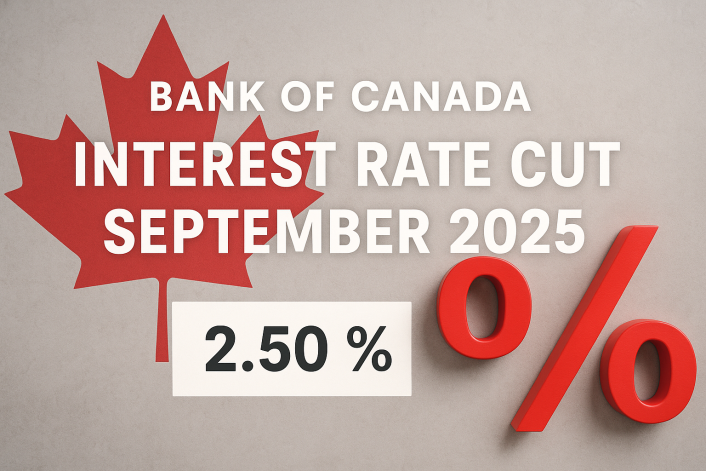

Bank of Canada reduced its target for the overnight rate by 25 basis points, from 2.75 % to 2.50 Date: […]

As we approach the heart of summer 2025, Canada’s real estate market is entering a new phase—one defined by stabilization, […]

Bank of Canada April 2025 interest rate decision

2025 is your year to turn homeownership into wealth. Discover the opportunities in Canadian real estate investing today!

Discover the magic of finding your dream home this holiday season, where cozy interiors meet festive charm, and new beginnings await under a blanket of snow.

Bank of Canada’s recent rate cut aims to ease financial pressures, with variable-rate borrowers seeing relief. Interestingly, fixed mortgage rates are now lower than variable ones, reshaping borrowing strategies in a shifting economic landscape.

The Bank of Canada has announced a reduction in its target for the overnight rate, bringing it down by 25 […]

In the ever-evolving landscape of the mortgage industry, choosing between a fixed and variable mortgage has become a critical decision […]

In the world of real estate, first impressions are not just important; they are everything. As a homeowner or a […]